- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

Medicare Advantage Open Enrollment Explained

January 31, 2025

Original Medicare’s New Prior Authorization Rules

August 7, 2025Three reasons you should consider buying Medigap Plan N

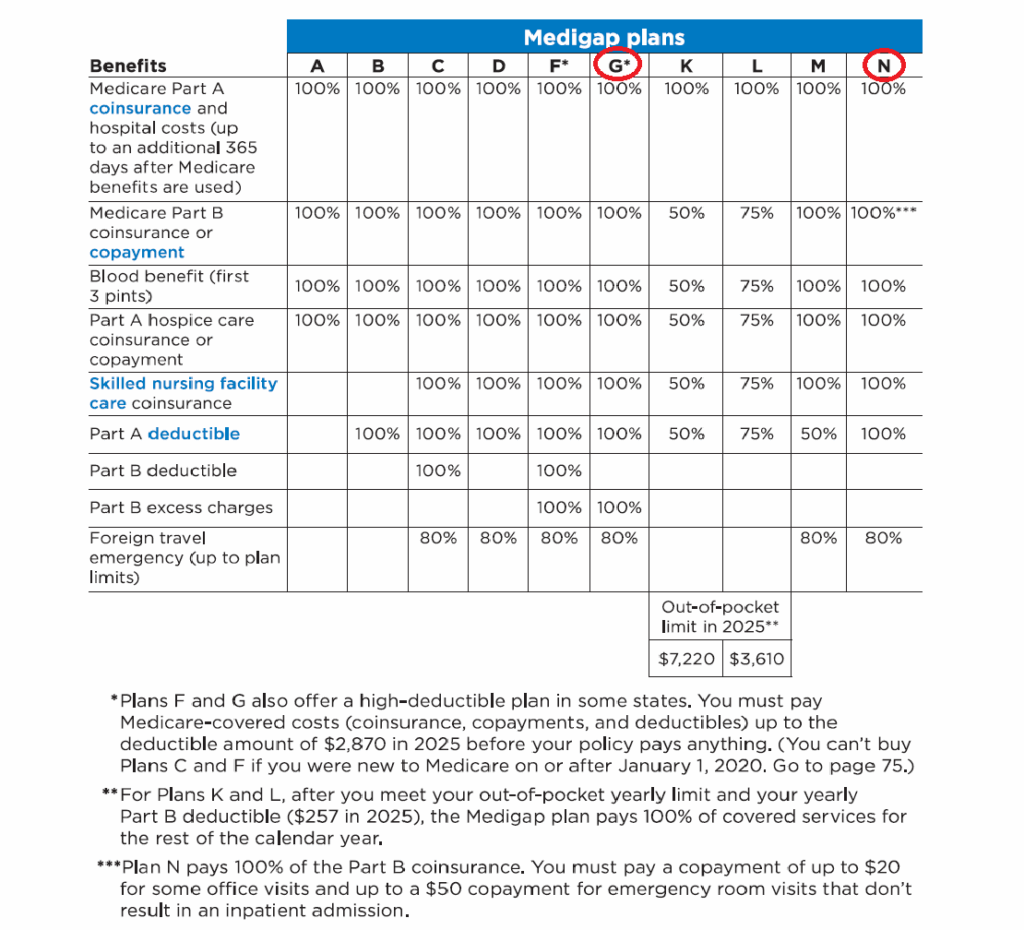

Original Medicare consists of Part A (80% hospital) and Part B (80% doctor/physician). You must meet the Part A and Part B deductibles before Parts A and B pay 80%, and then you would pay the 20%. There is no “cap” to the 20% coinsurance. For this reason, people buy a Medigap plan to help cover the deductibles and 20% coinsurance Medicare doesn’t cover. Medigap Plan N is one of ten standardized plans you can buy with Medicare Parts A and B.

What is a Medigap Plan?

A Medigap plan—also known as Medicare Supplement Insurance—is a type of private insurance that helps pay for healthcare costs that Original Medicare (Parts A and B) doesn’t cover. These can include copayments, coinsurance, and deductibles.

Think of it this way: Medicare covers a lot, but not everything. A Medigap policy helps “fill the gaps” in that coverage—hence the name.

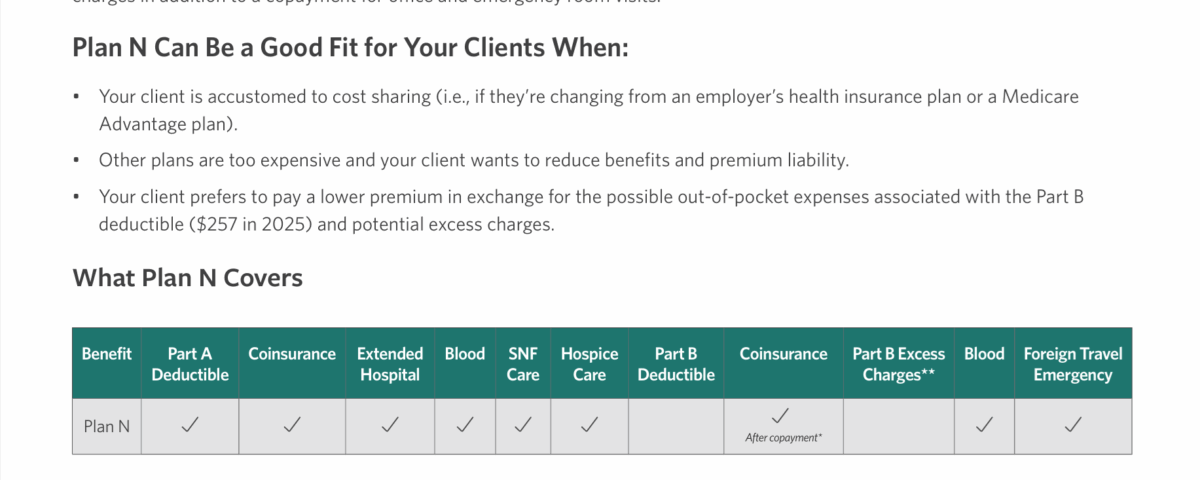

Medigap Plan Chart

1. Plan N does not cover the Medicare Part B deductible, but neither does Plan G.

Medigap Plan N and Plan G offer the greatest coverage to anyone who became eligible for Medicare on or after Jan. 1, 2020. Plan G provides greater coverage than Plan N. However, Plan N has lower premiums, which could result in cost savings. Since neither covers the Medicare Part B deductible, comparing these plans could be beneficial. The Medicare Part B calendar-year deductible amount may change each year.

2. Plan N copays are only for certain office and emergency room visits.

Unlike Medigap Plan G, policyholders may have a copay with Medigap Plan N. But there shouldn’t be a copay for every visit. Copays don’t come into effect until the Part B deductible is met, and when there is a copay, it will adhere to a maximum amount.

Specific medical codes result in a copayment or coinsurance with the Medigap Plan N. These are specific to patient evaluation and based on the provider’s time with the patient.

For example, physical therapy appointments do not have a copay unless the practitioner evaluates the patient and uses one of the specific copay codes. Only a handful of specialist codes can trigger a copayment or coinsurance.

If these codes are used, you could expect to pay 20% of Medicare’s allowable charge (Medicare-approved amount), but no more than $20. This means that if you have a $70 Medicare charge, your copay will be $14. The copay for a $150 visit will be a maximum of $20.

A visit to the emergency room will also result in a copay of 20% of Medicare’s allowable charge, but no more than $50. In 2017, the average cost per ER visit for individuals ages 65 and up was $690. At that amount, 20% would amount to a $138 copay, yet the maximum copay charge with Plan N is $50.

If you’re admitted to the hospital, the copay would be waived. When possible, a visit to urgent care can ensure no copayment or coinsurance under Plan N since urgent care has a unique code.

Medigap Plan N policyholders usually won’t see copays for preventive services, such as an annual physical wellness check.

3. Excess charges are usually not excessive.

Another difference from Medigap Plan G is that policyholders with Medigap Plan N may be subject to excess charges from providers who do not accept Medicare “Assignment,” or Medicare’s reimbursement as payment in full. This means you could face an additional charge of up to 15% of Medicare’s allowable charge.

The good news is that 98% of clinicians accepted Medicare in 2023. Further, 99.7% of all Medicare claims submitted in 2021 were paid on assignment. This shows only a minimal chance you will face excess charges. 🙂

Excess charges are at the discretion of the provider’s office. If a doctor does charge excess charges, there should be a sign in the office that says they can charge more than the Medicare amount. Some states prevent or place limits on excess charges. For these reasons, many providers choose not to pursue excess charges due to the amount of work involved in collecting what is typically a small amount of money.

The difference in the plans’ premiums and future rate increases, especially since Plan N will likely see lower rate increases than Plan G, may outweigh the slight possibility of excess charges. Plan N is about $25+ less in monthly premiums than Plan G.

In Summary

Medigap Plan N is ideal for relatively healthy people accustomed to cost-sharing, such as coverage through an employer or group health plan, but who want the most comprehensive coverage and low premiums.

How do I buy a Medigap Plan N?

Our office can help you! As an independent insurance broker, we work with many leading insurance companies that offer Medicare Supplement (Medigap) insurance plans and can shop the market for you, for free. The insurance company compensates us.

We know the Medicare market and have the experience to advise you on which companies to consider and which to avoid. Don’t go it alone! You pay the same rates using an independent broker as if you went directly to the insurer.

Schedule a call with me here >> Medicare Plan Call with Chad

Call (888) 901-4870!