- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

What to Do When You Are Turned Down for Life Insurance

June 10, 2015

Tips for Seniors: How to Find an Insurance Plan that Meets Your Needs

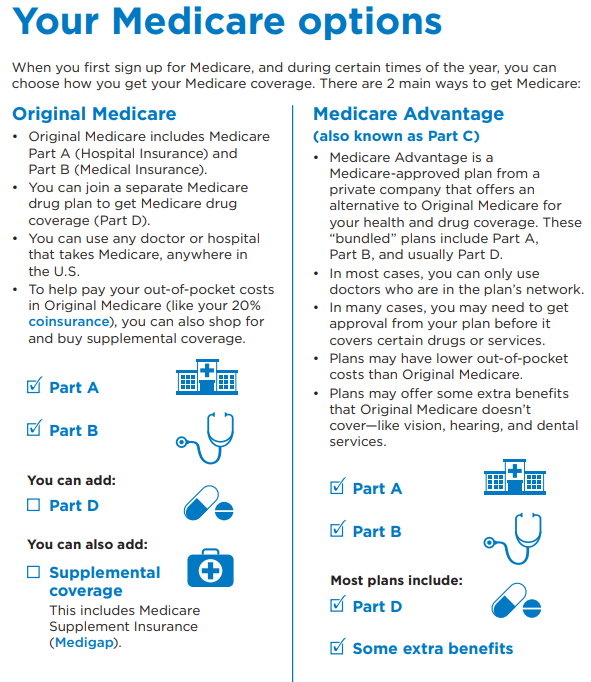

September 2, 2015Medicare Supplement coverage is a great way for seniors to supplement their existing Original Medicare coverage (Part A and B) and ensure that they are protected in the event of unexpected costs or unforeseen circumstances. If you’ve ever wondered about Medicare Supplement coverage, this is your chance to learn more. Here are five things seniors need to know about supplemental plans:

1) Medicare Supplement is Ideal For Seniors Who Want to Choose Any Doctor

Medicare supplement plans are a helpful way for seniors to expand their health insurance coverage. Ideal for seniors who want to have their pick of doctors who accept Medicare as well as those who want to afford themselves some extra protection against unforeseen circumstances and the unexpected costs often associated with Medicare. Medicare Supplement is a great way to expand coverage and promote freedom of choice within healthcare.

2) Medicare Supplement is Available to Many Seniors

Like Medicare, Medicare Supplement plans are available to all seniors aged 65 and older that already have Medicare Parts A and Part B. When you first are eligible for Medicare at age 65, you can take advantage of your Medicare Open Enrollment period, and enroll in any supplement plan of your choice- with NO health questions asked.

3) Medicare Supplement is Designed to Supplement Medicare Coverage

Medicare Supplement goes hand in hand with Medicare coverage and neither functions very well without the other. While Medicare covers many health care needs, it leaves important things out. These things are known as “gaps” and this is where Medicare Supplement comes in. Medicare supplement is designed to cover important expenses such as co-pays, deductibles and co-insurance costs in order to make healthcare easier and more accessible for seniors.

4) Medicare Supplement Plans Require a Private Insurance Policy Separate from Medicare’s

Although Medicare and Medicare Supplement are designed to work together, the way you pay for them is slightly different. When you’re enrolling in a Medicare Supplement plan, you can expect to pay the private insurance company’s monthly premium in addition to the part B premium that you already pay to Medicare.

5) Medicare Supplement Plans Only Cover a Single Individual

Because Medicare Supplement plans are designed to supplement an individual’s Medicare, they can only cover one individual. If you and your spouse both want Medicare Supplement coverage, you will need to purchase separate plans and pay separate premiums. Although, many carriers today offer some sort of a household discount.

For seniors looking for an insurance policy that will cover the gaps in their Medicare policy, Medicare Supplement can be a wonderful answer. Designed to supplement and complement Medicare plans, Medicare Supplement is designed to give individuals peace of mind and quality coverage.

To learn more about Medicare Supplement plans and learn how you can enroll, visit Lifelong Insurance, LLC today. Thank you!