- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

Medigap Plan Basics: What To Know Before You Buy

February 13, 2017

What Does a Trump Administration Mean For Medicare?

March 3, 2017Medigap Plan F or Medigap Plan G?

Hi, my name is Chad Cason and I want to take a moment and address a question I get all the time, which is… “should I buy a Medigap Plan F or a Medigap Plan G, to go with my Medicare Part A and Medicare Part B?”

But first, let me explain briefly what a Medigap plan is. Medigap IS Medicare Supplement insurance, it’s the same thing. It doesn’t matter if someone refers to a plan as a Medigap Plan G or A Medicare Supplement Plan G.

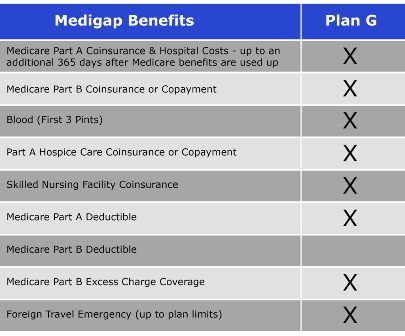

These plans pay the costs that Medicare Part A and Part B, don’t pay. Part A is your hospital coverage under Medicare and Part B is your doctor/medical coverage under Medicare. If you have Part A and Part B, you have only 80% coverage. Medigap plans, like the Medigap Plan G, pay the 20% coinsurance and Medicare deductibles for you.

Both plans… Medigap Plan F and Medigap Plan G, fill in the gaps of your hospital coverage under Part A, so that you have 100% coverage, nothing out of pocket.

The difference between these two plans falls under your Part B doctor/medical coverage. Both Plan F and Plan G fill in the gaps of your doctor coverage under Part B, so that you have 100% coverage under Part B as well. However on Medigap Plan G, you will be responsible for paying the Medicare Part B, calendar-year deductible ($185 in 2019) each year yourself, versus having the Plan F pay it for you. So if you have Plan G, your only out-of-pocket cost for any given year would be the part B deductible. Above that, everything else is covered at 100%.

Paying that deductible yourself, as you need it… saves you about 20-25$ a month in premiums, in addition to lower rate increases over the years. Usually, the Part B deductible is just spread out over the first couple of doctor visits during the year. Beginning Jan. 1st, 2020, Medicare Supplement “Medigap” Plans C and F will not be available for newly eligible Medicare beneficiaries… eligible for Medicare for the first time after Jan. 1st, 2020. You can read more on that legislation here MACRA.

In my opinion, Medigap Plan G is a better value than Plan F. Yes, Plan F pays the Part B deductible for you, however in exchange for that, you will pay more in monthly premiums and have some of the highest rate increases.

Again, the only difference between Medigap Plan F and Medigap Plan G is the Part B deductible, and as of 2019, it’s $185 total for the year.

If you have any questions at all about these plans or any other Medigap/Medicare Supplement plans, and if you would like to get rates on plans in your area, please call 888-901-4870, email or click here http://bit.ly/2XF3i1L to schedule a phone call with me.

I’ll be more than happy to help you figure it all out. Thank you.

-Chad Cason

2 Comments

[…] Use any doctor you choose who accepts Medicare. With other plans, there is a network of doctors you can see. Medicare Supplement (Medigap) insurance plans allow you to use any hospital or doctor that accepts Medicare. […]

[…] Is Medicare Supplement “Medigap” Plan F best or Medigap Plan G? Click Here […]