- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

Medigap Plans Comparison: Compare Plans A through N

November 10, 2015

Medicaid Spend-Down: What it is and What Seniors Need to Know

December 5, 2015Medicare and Other Insurance: How it Works

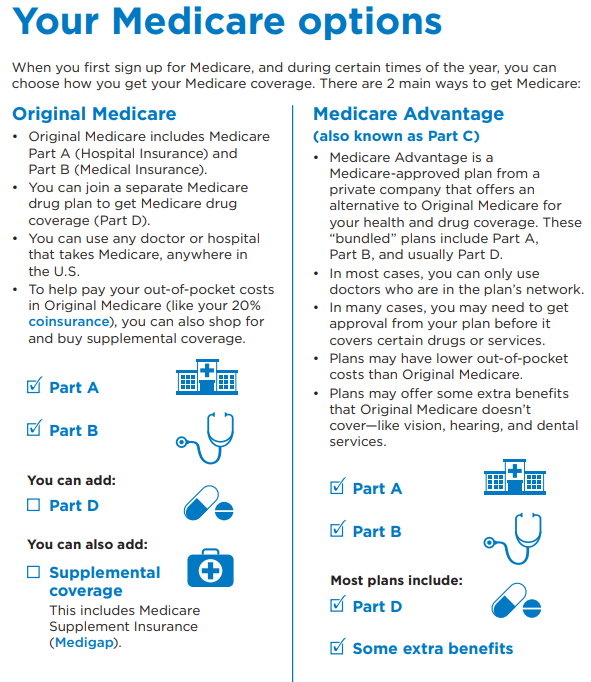

For people with Medicare and other insurance health plans or coverage, like from an employer health plan, the system can quickly get confusing. Fortunately, it doesn’t have to be. Learn how Medicare and other insurance works along with Original Medicare Part A and Part B.

When a person has multiple forms of coverage, each coverage plan is called a “payer” and “coordination of benefits” guidelines help decide which payer covers expenses first. For seniors and individuals who are unfamiliar with this system, here’s a set of simple guidelines for how it works.

The Primary Payer

The primary payer receives a person’s health bills first and pays on them until the plan reaches the limits of its coverage. If the entire bill is less than than the amount of the plan’s coverage, the primary payer will often pay the entire bill. If the total exceeds the plan’s coverage, however, the primary payer will pass the remainder of the bill to the secondary payer. If the primary payer doesn’t handle the bill within 120 days of it being issued, the doctor or secondary payer may send the bill along to Medicare, which may pay the bill until primary payment comes through, at which point Medicare will recoup costs from the primary payer.

The Secondary Payer

The secondary payer only pays on medical expenses if the primary payer didn’t cover all costs. Depending upon who the secondary payer is and what its plan covers, it may not pay all of the leftover medical costs. In cases where employer insurance is the secondary payer, it may be necessary for individuals to secure Medicare Part B coverage before medical expenses can be paid.

Conditional Payments

In some cases, Medicare may make “conditional payments” on health expenses. This means that Medicare will pay for a service that another payer is technically responsible for. In these cases, Medicare covers these expenses so that seniors and other insured individuals won’t have to dip into their own pockets to cover the bill. These are called “conditional payments” because Medicare makes the payment on the condition that it can reclaim the expense from the original payer. When conditional payments are made, the insured person is typically responsible for ensuring that Medicare is repaid for its conditional payment expenses.

In order to do this, insured individuals need to contact the Benefits Coordination & Recovery Center (BCRC), where they will be paired with a representative who will work on the case.

While coordinating coverage through Medicare and other forms of insurance can be difficult, it is not quite as complex as it sounds and there is plenty of assistance available to individuals seeking to sort out conditional payments.

- Medicare pays first for your health care bills

- Your group health plan coverage pays second

How your retiree group health plan coverage works depends on the terms of your specific plan. Your employer or union, or your spouse’s employer or union, might not offer any health coverage after you retire. If you can get group health plan coverage after you retire:

- It might have different rules

- It might not work the same way with Medicare

For more information on your Medicare coverage options or if you have questions regarding your current health insurance situation, please contact us. If you will be taking Medicare, but maybe have other employer/retiree insurance available, we can help you compare that coverage with going on Medicare and buying a Medicare Supplement plan, Part D Rx plan, etc.

Please call us directly at (888) 901-4870 or visit our contact us page and leave us your information!