- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

December 8, 2023

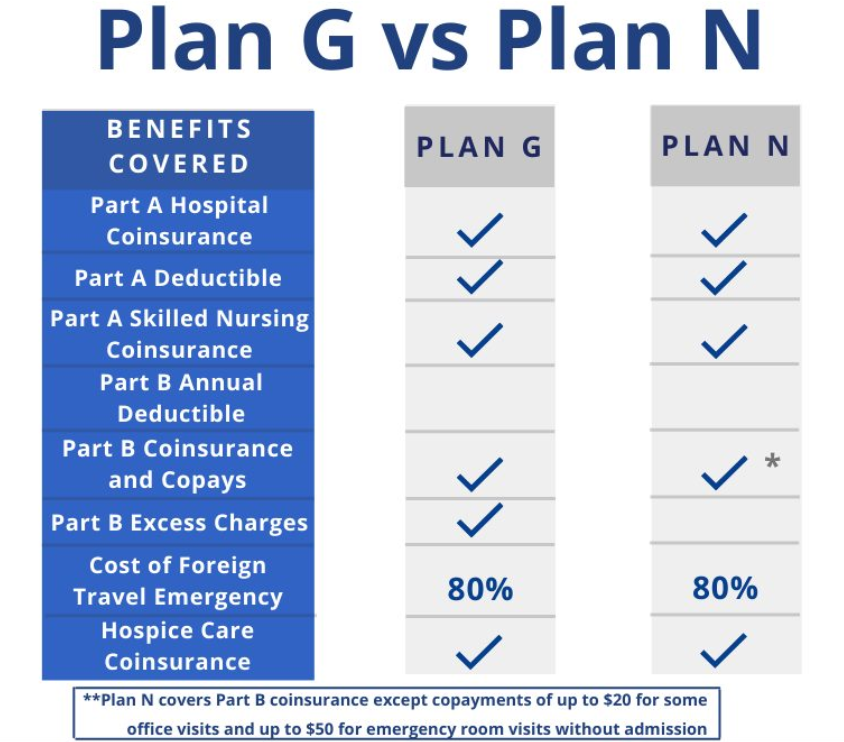

Top Medicare Supplement Questions and Answers As a licensed independent Medicare Supplement (Medigap) agent since 2010, I’ve been asked many questions about Medicare and “supplemental” plan […]

May 16, 2022

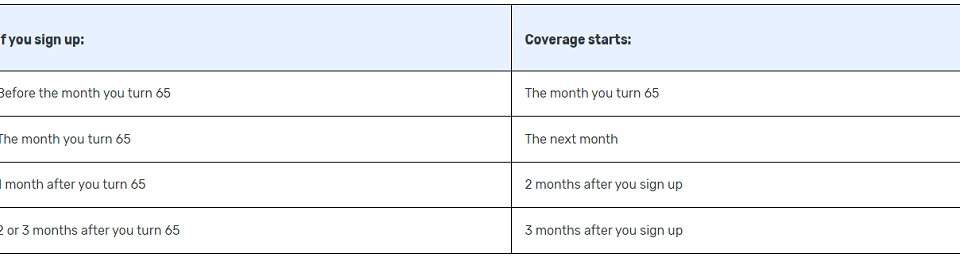

Medicare Part B start date When do Medicare Part A and Part B start? Original Medicare includes Part A (80% Hospital Insurance) and Part B (80% […]

September 8, 2021

What is the Medicare Part B Give Back Benefit? We’ve all seen the commercials with Joe Namath, and now Jimmie Walker “Dyn-O-Mite!”… regarding your Medicare coverage […]

July 14, 2021

Why Mutual of Omaha for Medicare Solutions? As an independent insurance agency, I offer many highly reputable companies in the Medicare Market. One of those being […]