Why Mutual of Omaha for Medicare Solutions?

As an independent insurance agency, I offer many highly reputable companies in the Medicare Market. One of those being Mutual of Omaha. Mutual of Omaha offers Medicare Supplement “Medigap”, Dental, and Medicare Part D Rx insurance plans.

When choosing a carrier, you want to be confident knowing they know what works. Mutual of Omaha’s portfolio of Medicare products and plans provide the coverage you want at competitive rates, and with excellent customer service. If I’m your agent, I would be your main contact for any questions or concerns related to your policy.

Mutual of Omaha offers:

- An experienced company that has been offering Medicare supplement since 1966

- Technology for ease of doing business including e-applications and mobile quote apps

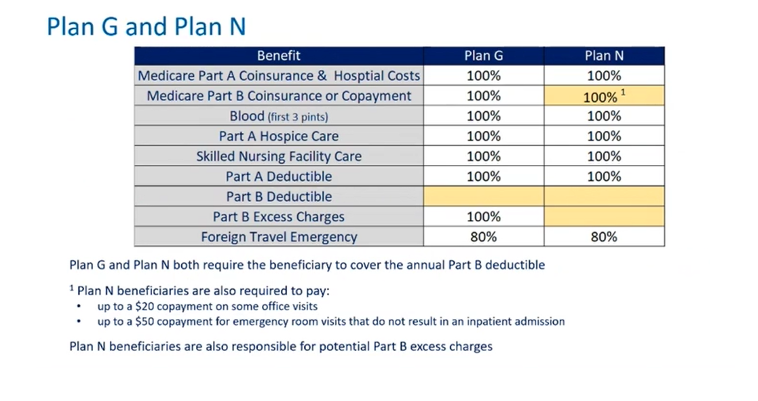

- Popular Medicare supplement plans such as competitive Plan G and cost-saving Plan N

- Dental Solutions that offer you a 15% Multi-policy discount* when purchased with Medicare supplement policy

- Mutual of Omaha Rx Plus℠ and Mutual of Omaha Rx Premier℠ offers affordable premiums and low copayments for your drugs

- Reduced dental rates by 10% on Mutual Dental Protection℠ in most states

- Added benefits for you with no policy fees, anniversary rating and more

Why choose Medicare Supplement?

Because Original Medicare pays for only about 80% of your coverage.

Medicare Supplement (also known as Medigap) covers things that Original Medicare doesn’t, like copays, deductibles, and coinsurance. It does all this with a steady, predictable, monthly bill you can budget for. And it can’t be cancelled. It will be renewed for as long as you pay your premium on time.

Is Medicare Supplement Insurance the right fit for you?

It’s a great fit!

- You have or are planning to enroll in Original Medicare (Parts A and B).

- You want more coverage than Part A and Part B give.

- You’d rather pay a monthly, predictable bill than have to pay out of pocket for a large, unexpected medical bill.

- You want to see any doctor who accepts Medicare — and you want to see them without a referral.

- You like the flexibility and control of buying a separate dental and vision plan.

- You want to be able to travel across the world with the confidence you will be covered.

- You want the peace of mind that your insurance can’t ever be cancelled, as long as you don’t miss a premium.

It’s not the best solution for you.

- You are not planning on enrolling in Original Medicare (Parts A and B).

- Your employer or your union help cover costs that Part A and Part B don’t cover.

- You have Medicare Advantage (Part C) or are about to sign up for it.

Benefits of Medicare Supplement Insurance

- Your Doctors and Hospitals, Your Choice – Wherever You Are

- Travel the World with Confidence

- Take Your Coverage Coast-to-Coast

- Keep Your Coverage, Year After Year. Your Medicare Supplement insurance policy can’t be cancelled. It’ll be renewed as long as you pay the premiums on time.

When can I apply for Medicare Supplement Insurance?

Your open enrollment period starts when you turn 65 or when you first sign up for Part B. It lasts for 6 months. This is the best time to sign up, because you’ll get the best possible rate and can’t be denied for a pre-existing condition. After this 6-month window closes, you can still apply but the insurance company may use medical underwriting. There is also the possibility that you could be denied.

Mutual of Omaha has been around for more than 100 years. Here are a few reasons why!

As a mutual company, they aren’t beholden to Wall Street. Since 1909, they’ve existed for the benefit and protection of their customers. I can help you with finding the right plans and rates in your area and I’m here to offer solutions and provide peace of mind.

Mutual of Omaha pays 98% of Medicare claims within 12 hours, so you don’t have to worry about the status of your claims.

They’re constantly looking for ways to better help their customers. Mutual of Omaha has been providing Medicare Supplement insurance since Medicare started in 1966 – more than 52 years ago. You can count on them for a great Medicare plan, and for the support you need to choose your perfect coverage.

To learn more about what Mutual of Omaha can offer you for Medicare supplement, Dental and Prescription Drug Plans, I can help! See below for my contact information. 🙂

Schedule Call with Chad Now!

*Dental Multi-policy discount is not available in WA, CO, and NM. The dental application must be signed on or after the Medicare application sign date, and within 30 days after the Med supp issue date.