- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

Medicare Supplement Plan N (Medigap Plan N)

June 10, 2020

Medicare Annual Enrollment

October 16, 2020Medicare Part D Senior Savings Model

The Centers for Medicare & Medicaid Services (CMS) has announced a new Model, the Medicare Part D Senior Savings Model (or the “Model”).

The voluntary Model tests the impact of offering Medicare beneficiaries an increased choice of enhanced alternative Part D plan options that offer lower out-of-pocket costs for insulin.

Background

One in every three Medicare beneficiaries has diabetes, and over 3.3 million Medicare beneficiaries use one or more of the common forms of insulin.

For some of these beneficiaries, access to insulin can be a critical component of their medical management, with gaps in access increasing risk of serious complications. These range from vision loss to kidney failure to foot ulcers (potentially requiring amputation) to heart attacks.

Unfortunately, sometimes the cost of insulin can be a barrier to appropriate medical management of diabetes. CMS’s Medicare Part D Senior Savings Model is designed to address President Trump’s promise to lower prescription drug costs.

This would provide Medicare patients with new choices of Part D plans that offer insulin at an affordable and predictable cost where a thirty-day supply of a broad set of plan-formulary insulins costs no more than $35.

Model Details

CMS is testing a change to the Manufacturer Coverage Gap Discount Program (the “discount program”) to allow Part D plans, through eligible enhanced alternative plans, to offer a Part D benefit design that includes predictable copays and costs in the deductible, initial coverage, and coverage gap phases. This is done by offering supplemental benefits that apply after manufacturers provide a discounted price for a broad range of insulins included in the Medicare Part D Senior Savings Model.

The Model aims to reduce Medicare expenditures while preserving or enhancing quality of care for beneficiaries, and to provide beneficiaries with additional Part D prescription drug plan (PDP) choices, for beneficiaries who receive Part D coverage through both standalone PDPs and Medicare Advantage (MA) plans that provide Part D prescription drug coverage (MA-PDs). These Model-participating plan benefit packages (PBPs) will provide stable, predictable copays for insulins that beneficiaries need throughout the different phases of the Part D benefit.

Specifically, CMS is enabling health plan innovation to offer beneficiaries lower prescription drug out-of-pocket costs by waiving a current programmatic disincentive for Part D sponsors to design prescription drug plans that offer supplemental benefits to lower beneficiary cost sharing in the coverage gap phase of the Part D benefit for insulin.

While Part D sponsors may currently offer prescription drug plans that provide lower cost sharing for brand and other applicable drugs in the coverage gap, if a Part D sponsor chooses to design its benefit that way, the sponsor would accrue costs that pharmaceutical manufacturers would normally pay. Those costs are then passed on to beneficiaries in the form of higher supplemental premiums.

Costs for the Medicare Beneficiary

Because Part D sponsors compete to offer Medicare beneficiaries affordable prescription drug coverage, only a few sponsors design a benefit that has supplemental benefit coverage for brand or other applicable drugs in the coverage gap. Since brand and other applicable drugs are the set of medications that often cost beneficiaries the most, beneficiaries end up paying 25 percent of the negotiated price in the coverage gap, which may closely mirror the list price of the medication. That amount is often a significantly higher than in the initial coverage phase and can represent a financial burden for Medicare beneficiaries.

Beginning January 1, 2021, CMS is testing a change where Part D sponsors that participate in the Model offer beneficiaries prescription drug plans that provide supplemental benefits for insulin in the coverage gap phase of the Part D benefit. Participating pharmaceutical manufacturers will pay the 70 percent discount in the coverage gap for the insulins that are included in the Model, but those manufacturer discount payments would now be calculated before the application of supplemental benefits under the Model.

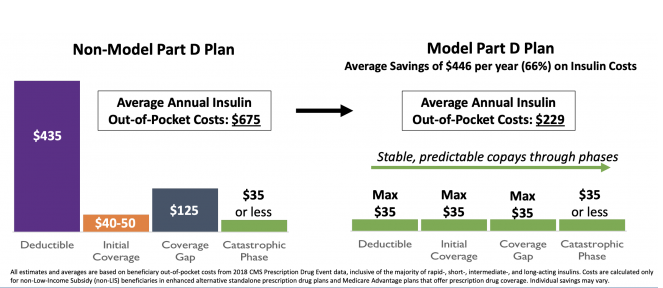

Part D sponsors participating in the Model will offer beneficiaries plan choices that provide broad access to multiple types of insulin, marketed by Model-participating pharmaceutical manufacturers, at a maximum $35 copay for a 30-days’ supply in the deductible, initial coverage, and coverage gap phases of the Part D benefit. As a result, beneficiaries who take insulin and enroll in a plan participating in the Model should save an average of $446 in annual out-of-pocket costs on insulin, or over 66 percent, relative to their average cost-sharing today. This predictable copay will provide improved access to and affordability of insulin in order to improve management of beneficiaries who require insulin as part of their care.

CY 2021 Participating Part D Plans and Pharmaceutical Manufacturers

To encourage broad Part D sponsor participation, CMS is providing Part D sponsors the option of additional risk corridor protection for Calendar Year (CY) 2021 and CY 2022 for plan benefit packages (PBPs) that have higher enrollment than average from insulin-dependent diabetic patients, when the PBP meets qualifying criteria. Through the Model, CMS is also testing how participating Part D sponsors may best encourage healthy behaviors and medication adherence through Part D Rewards and Incentives programs.

The following pharmaceutical manufacturers are participating in the Medicare Part D Senior Savings Model for CY 2021:

- Eli Lilly and Company

- Novo Nordisk, Inc. and Novo Nordisk Pharma, Inc.

- Sanofi-Aventis U.S. LLC

Do you have Medicare questions? Please call Chad Cason direct at (888) 901-4870!