- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

Medicare Plan Options Turning 65

April 3, 2020

Medicare Part D Senior Savings Model

August 2, 2020Medicare Supplement Plan N (Medigap Plan N)

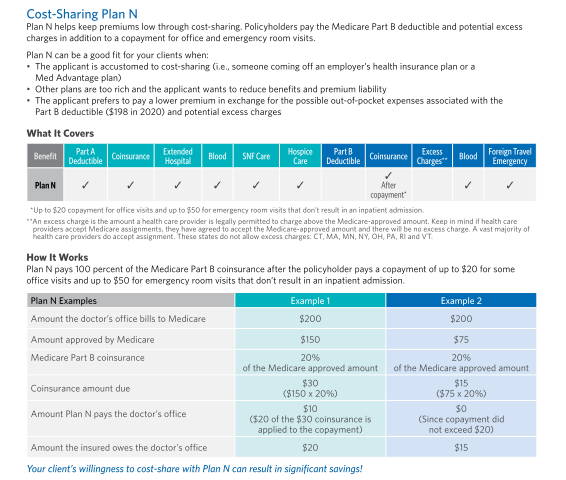

As the Medicare and Medicare supplemental insurance landscape continues to change, the Medicare Supplement Plan N, now also being referred to as the “Cost-Sharing Plan N”, is becoming more and more popular.

Cost-Saving Plan N can help you save money, here’s how:

Medicare Supplement Plan N helps keep premiums low through cost-sharing. Policyholders pay the annual Medicare Part B deductible and potential Part B Excess charges, in addition to a co-payment for office and emergency room visits. Learn more below.

Medicare Supplement Plan N is a great fit if:

- The applicant is accustomed to cost-sharing (i.e., someone coming off of an employer’s health insurance plan or another type of Medicare plan, such as a Medicare Advantage “Part C” plan).

- Other plans are too rich and the applicant wants to reduce benefits and premium liability.

- The applicant prefers to pay a lower premium in exchange for the possible out-of-pocket expenses associated with the calendar-year Medicare Part B deductible ($198 in 2020) and potential Medicare Part B Excess charges (Tip: If your doctor or provider accepts Medicare & Medicare’s reimbursement rates as payment in full, there will be no excess charges… AND excess charges are only up to 15% of the balance.)

The Medicare Supplement Plan N pays the:

- Medicare Part A deductible ($1408 per occurrence, for 2020)

- 100% of the 20% coinsurance not covered under Medicare Part A (80% Hospital charges)

- 100% of the 20% coinsurance not covered under Medicare Part B (80% Doctor/Physician charges). This is after the policyholder meets the calendar-year Part B deductible ($198 in 2020). In addition, you may incur a co-payment of up to $20 for some office visits and up to $50 for emergency room visits that don’t result in an inpatient admission.

More on the Part B excess charge:

An excess charge is the amount a health care provider is legally permitted to charge above the Medicare-approved amount. Keep in mind if health care providers accept Medicare assignments, they have agreed to accept the Medicare-approved amount and there will be no excess charge. A vast majority of health care providers do accept assignment. These states do not allow excess charges: CT, MA, MN, NY, OH, PA, RI and VT.

Medicare Supplement Plan N Examples:

Your willingness to cost-share with Medicare Supplement Plan N can result in significant savings!

Do you want real rates for the Plan N in your zip code? If so, you can get quotes at the top right corner of this page. For more plan N company specific information, call me directly at (888) 901-4870 or schedule a phone appointment with me by clicking here: Schedule Call with Chad